Pilot Raises $60M Series C to Modernize the Back Office

Category : Bookkeeping

Content

In addition, they have a staff of bookkeeping specialists working on your books and a team of developers developing technologies to automate some of the bookkeeping labor. Provide bookkeeping solutions for accounting firms that service every industryfrom restaurants to churches and healthcare providers and construction companies.

- Beyond general journal and ledger bookkeeping, an accounting firm also can perform account reconciliation, payroll processing, cash flow management, monthly statement preparation, and tax services.

- Pilot accounting is tailored to meet the needs of rapidly expanding firms and includes benefits tailored to high-growth-potential entrepreneurs.

- When you sign up for Pilot, you’ll be assigned a dedicated bookkeeping expert who’ll serve as your point of contact.

- Bench also offers catch-up bookkeeping for $299 per month if you need to get your books up to date quickly.

- Finding the right automated accounting solution for all your bookkeeping needs can become the foundation of your practice and the differentiator you need to grow.

If you’ve done your own search for accounting firms, you know there are dozens from which to choose. So, narrowing your choices to the ones that best suit your needs can be daunting.

What We Recommend Pilot Bookkeeping For

You should ask how the firm bills, and I recommend trying to get a fixed monthly fee that you can pay every month . You definitely don’t want to be stuck in an annual contract if you’re not getting the level of service you deserve. And if you run a fast-growing business or a startup, ask how your fees will change as you grow and your accounting becomes more complex. Although it’s a virtual service, Bench personalizes its clients’ experiences by assigning them a dedicated team of in-house professionals. The team takes over all bookkeeping functions, including setting up your account and linking it with all your financial accounts to upload data.

Pilot gives you a dedicated financial expert who acts as your main point of contact while the bookkeeping team operates behind the scenes. The best customer support enables fluid, real-time conversations to help troubleshoot issues and answer questions as they arise. They offer you multiple means of contacting them including email, chat, and direct message within the platform for your convenience. Choose an automated accounting solution that understands the value of being there when you need it. With a special blend of custom software and experts, Pilot delivers accurate, consistent bookkeeping, tax preparation, and forecasts that give entrepreneurs the freedom to focus on their business. Pilot integrates directly with the billing, banking, expense and payroll systems customers already use, and delivers insights that simply aren’t possible to get anywhere else. Specialization in your industry.For some businesses, this may not matter.

Pilot Signals

Our support team is happy to help, whether it’s a question about our software or advice on how to best tackle bookkeeping tasks. Pilot Plus includes everything in Pilot Core, plus support for multiple entities and locations, AR and AP, inventory bookkeeping, and special revenue recognition. Pilot provides accurate bookkeeping each month saving you time and resources if you’re still doing it yourself. Their solution aims to replace your existing bookkeeping efforts. Botkeeper is able to fully automate your bookkeeping department with human-assisted AI.

In fact, a 2016 survey we conducted of U.S. business owners found that more than 80% of U.S. small businesses do their books using the cash basis of accounting. However, if your external CPA recommends accrual accounting for your tax filing, he or she can easily use your Bench-provided cash-basis financial statements to file an accrual-basis return. Because your books are in order, the conversion process is easily handled.

Pilot Accounting

And Kruze has deep experience with VC-backed startups and uses automation to drive down costs and save startup founders time. If you look at the top 10 accounting firms, the 8th firm on the list has $1.1 billion in revenue in 2020. CLA employs 848 partners and 4,412 professionals in over 100 offices. Tim worked as a tax professional for BKD, LLP before returning to school and receiving his Ph.D. from Penn State. He then taught tax and accounting to undergraduate and graduate students as an assistant professor at both the University of Nebraska-Omaha and Mississippi State University. Tim is a Certified QuickBooks Time Pro, QuickBooks ProAdvisor for both the Online and Desktop products, as well as a CPA with 25 years of experience. He most recently spent two years as the accountant at a commercial roofing company utilizing QuickBooks Desktop to compile financials, job cost, and run payroll.

Forbes has a scathingteardown, alleging that accounting mistakes cost clients tens of thousands of dollars — and that the company itself potentially had accounting irregularities . The trial includes one historical month of bookkeeping and a full tour of the Bench platform. Even if you choose not to continue after your free trial is up, you can keep the income statement and balance sheet prepared by your Bench bookkeeper. Accrual bookkeeping, which records revenue when earned and expenses when paid, regardless of when cash changes hands, is usually only required for large companies that need GAAP-based financial statements. With this system, bookkeepers record transactions when the money has been deposited into the client’s bank account or charged to their bank or credit card.

Bookkeeper360

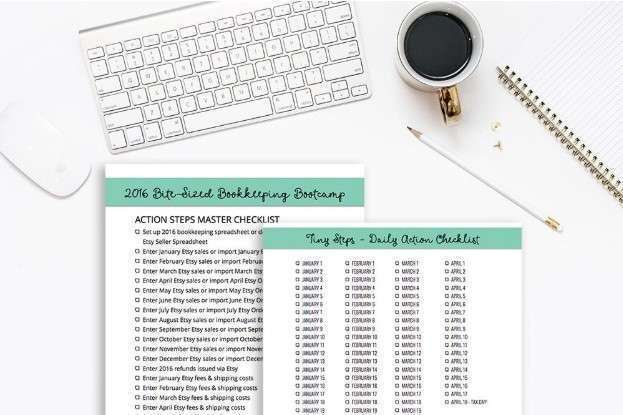

But to ensure that your dedicated bookkeeper made the right corrections, your books will undergo a third and final review. A peer reviewer from Pilot will take a look at the flagged transactions to ensure that all corrections are appropriate or detect if your dedicated bookkeeper missed something. Customer context is performed during onboarding, but the dedicated bookkeeper will update this information so other Pilot bookkeepers can access it easily. The rest of the steps in the checklist will be routine bookkeeping procedures.

- In addition, they have a staff of bookkeeping specialists working on your books and a team of developers developing technologies to automate some of the bookkeeping labor.

- Pilot leverages a combination of elements of automation and integrations with human bookkeepers.

- Plus, Bench has nearly 700 reviews on Trustpilot and 64 reviews on G2, versus two Trustpilot reviews and 35 G2 reviews for Pilot.

- We extract data from receipts, process payroll, pay bills, send invoices, reconcile accounts, and generate beautiful reports.

- When Reviewbot flags certain transactions, it’ll alert your dedicated bookkeeper to check them.

Select plan receives priority support, expedited bookkeeping delivery and recurring monthly phone reviews. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Now that you know the differences and similarities between the three online bookkeeping services, you can start thinking about which one works best for you, your business, and your budget.

Alternatives to Pilot Bookkeeping

Pilot Bookkeeping is a financial service provider tailored to startups and small and medium-sized businesses . Aside from its bookkeeping solutions, it also offers advice to growing businesses from CFO consultants and tax advisors. Pilot connects your business with a dedicated account manager who’ll learn the ins and outs of your business quickly. Using a blend of custom software and expert bookkeepers, Pilot can deliver accurate bookkeeping at a price that can be customized based on the needs of your business. Use of cloud technologies.Small business owners and startup founders should look for automation and cloud technologies that save them time and money. Look for a bookkeeper or accounting firm that uses cloud accounting services likeXeroorQuickBooks Online, not desktop solutions.

What can a bookkeeper not do?

- Record all transactions and assign them to a relevant account.

- Pay and issue invoices on your behalf.

- Verify receipts.

- Prepare basic financial statements.

The software is specially designed for bookkeeping, tax preparation and CFO services. Pilot offers a team of finance experts that manages businesses efficiently, reduces the extra burden, saves time and enhances productivity. It generates industry-specific reports with monthly statements that feature custom statements on inventory management for eCommerce and burn reports for startups.

Bench is more established than Pilot—we’ve been serving small businesses since 2012, versus 2016 for Pilot, and have 2.5X more employees than Pilot, giving us an unmatched depth of expertise. The dashboard is relatively basic and it would be nice to have additional account features for adding users, setting up 2FA, etc.

Because Bookkeeper360 is easily customizable, it’s a good fit for a wide range of small enterprises. You can work with a specialized accountant for on-demand bookkeeping on a pay-as-you-go basis or choose a monthly or weekly plan utilizing the cash or accrual-based accounting technique. For organizations with up to $20,000 in monthly costs, monthly reconciliation plans utilizing the cash method start at $399 per month. Pilot accounting is tailored to meet the needs of rapidly expanding firms and includes benefits tailored to high-growth-potential entrepreneurs.

If you’re playing the cashback game and/or have income coming in from many places like an influencer such as myself, I do not recommend Bench.” – Christan T. Our pricing starts at just $89 per month and we offer the option to pay monthly instead of annually, unlike Pilot. Once we get familiarized with your business, we’ll help you determine the right accounting solution for your needs. We work with both certified practicing accountants and AI technology to bring business owners and startup founders the help that they need. Know exactly what you’re paying for and getting so you can get the best price every time. “Our engineers have built a ton of software to help our team do the work more accurately, more reliably, and more consistently.

- Also, 1-800Accountant offers every business a free tax savings consultation with an expert.

- Accounting firms are traditionally valued at around 1x annual revenue .

- Our licensed, in-house advisory team will advise on tax planning and efficiency—it’s like having a CPA on staff without the expensive billable hours.

- The challenge for small businesses is finding the right accounting firm out of the dozens available to fit their needs.

- Plans for Pilot Bookkeeping start at $599 per month for businesses with less than $30,000 in monthly expenses.

- Pilot CFO Services is another perk for startups that need even greater financial guidance.

The bookkeeper will become acquainted with your financial situation, link any financial program with QuickBooks Online, and set up your automatic transaction import. Pilot works with third-party apps like QuickBooks and Stripe, and it can handle an infinite number of transactions and connections. In addition, it is accessible on a yearly subscription basis, including phone and email assistance. Growth Enablement White-Glove Success, Beyond Bookkeeping Get hands-on training in Botkeeperfor you, and your clients. Experience a suite of resources that go beyond bookkeeping, and help your drive more growth, take on more clients, stimulate learning Botkeeper best practices, and more. Resource Center Tools and guides available at your fingertips Our team is here to help!

It allows users to connect their existing services such as Gusto and Expensify and automates data collection. The reporting functionality generates monthly reports which include profit and loss statements, balance sheets, and cash flow statements. Pilot integrates with third-party applications such as Quickbooks and Stripe and supports unlimited transactions https://www.bookstime.com/ and connections. Online accounting firms typically charge a monthly fee, which can help businesses to plan their expenses. For many firms, the monthly fee is based on the level of services you need. You can pay as low as $150 a month for a starter package that includes day-to-day bookkeeping, account reconciliation, and financial report preparation.

In-house tax teams.Many businesses can successfully use a separate tax preparer from their bookkeeper, so you may not need tax specialists in-house at the bookkeeping firm you choose. However, if you manage a business with a complicated tax situation, having one firm handle your books and taxes in-house is a good idea. If you are highly profitable or running a pass-through business, then you’ll want your bookkeeper helping you make tax decisions through the year. I know some firms say they do the tax work in-house but then secretly farm it out to another company or contractors. So if taxes matter to you, I’d ask if the tax team consists of W-2 employees or not. Launched in 2017, Pilot Bookkeeping is a financial services firm that focuses on providing bookkeeping, chief financial officer , and tax services for startups and small businesses. Pilot is a virtual service that manages bookkeeping for businesses.

This is where Pilot, winner of VentureBeat’s 2021 AI Business Application Innovation award, comes in. Started by successful startup entrepreneurs, Pilot understands the challenges other startup entrepreneurs face in keeping the books and preparing their businesses for growth. That’s why we chose Pilot as the best accounting firm for startup businesses.

When Reviewbot flags certain transactions, it’ll alert your dedicated bookkeeper to check them. Reviewbot can only spot anomalies in the records and lets the dedicated bookkeeper resolve these issues manually. In the image below, you’ll see an example of flagged transactions spotted after the initial review. Pilot pilot bookkeeping has a tool called Reviewbot that will initially review transactions and check for missing or erroneously categorized transactions. Reviewbot can filter out transactions that the dedicated bookkeeper need not review manually. Instead, Reviewbot will only flag transactions that need manual adjustment or correction.

It also will look for candidates who are conversant in your software, such as QuickBooks, Xero, Netsuite, and many other programs. Payroll services also are available from 1-800Accountant for getting your employees paid, withholding taxes, and taking care of your payroll taxes. By joining our newsletter you now have access to unlimited software deals, latest software products & industry insights. All of the company’s bookkeeping plans contain burn-rate estimates, especially crucial for venture capital or investor funding organizations. If you have any questions during the month, you may contact your account manager for free via the QuickBooks site or email. System integration – Your account manager will show you how to link QuickBooks with your existing procedures and software so that they can automate as much of your bookkeeping as feasible. With Pilot bookkeeping, you won’t have to worry about anything.